- #MONTHLY EXPENSES FORM HOW TO#

- #MONTHLY EXPENSES FORM PDF#

- #MONTHLY EXPENSES FORM PRO#

- #MONTHLY EXPENSES FORM FREE#

Data Required for Completing the 122A Forms and the 122C Forms However, we and the clerk of your local bankruptcy court are prohibited from providing any legal advice.

#MONTHLY EXPENSES FORM PRO#

The source data reproduced here is also available directly from the IRS and Census Bureau using the links at the bottom of this page.įor questions related to this data, e-mail: For general assistance in filing for bankruptcy relief, the clerk of your local bankruptcy court or your local state Bar Association may have information regarding individuals or organizations offering bankruptcy related services, including on a reduced fee or pro bono basis. This Web site reproduces the Census Bureau and IRS Data necessary to complete the 122A Forms and the 122C Forms.

#MONTHLY EXPENSES FORM HOW TO#

Learn how to make a budget in Excel with built-in tips and intuitive design. Official Form 122A-1 (Chapter 7 Statement of Your Current Monthly Income), Official Form. This template can be customised to suit your style and preferences. It can also be used to make smarter financial decisions.

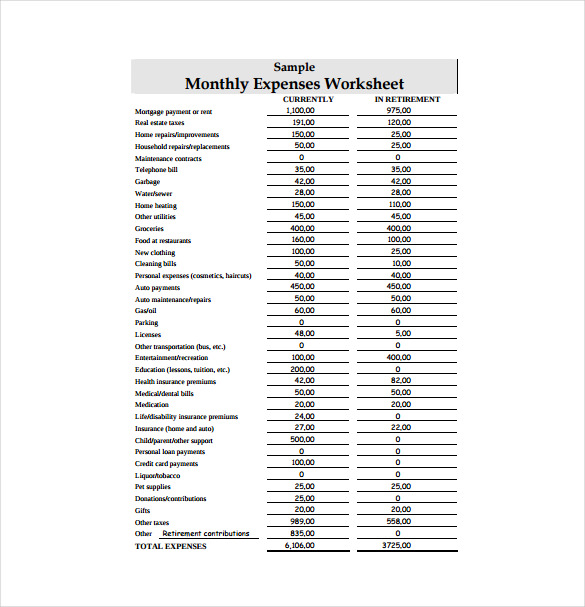

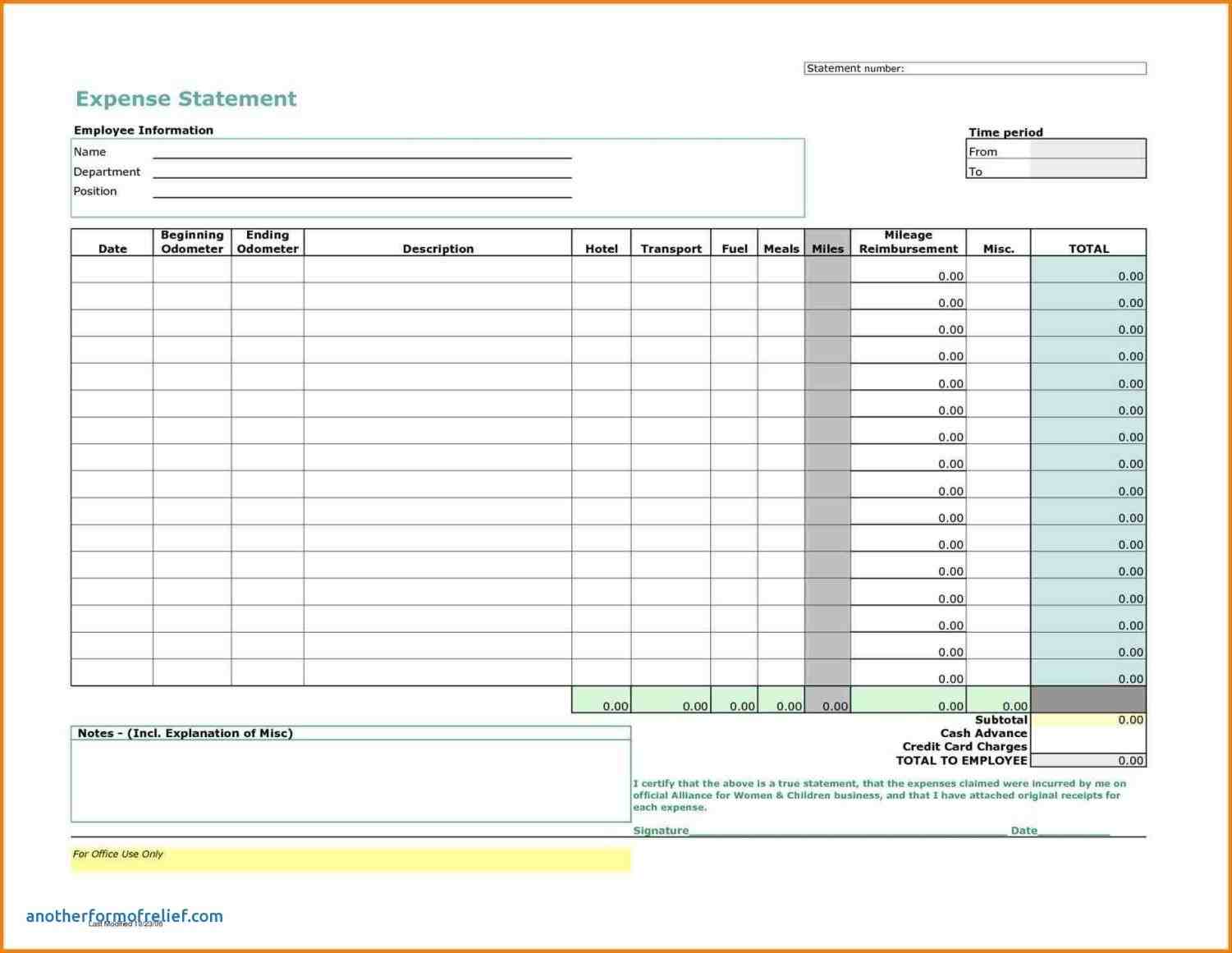

This expense form is designed to help individuals and businesses document and track daily expenses. Input income and expenses into the customizable tables and watch Excel do the rest. Capital Expenses Capital expenditures, commonly known as CapEx, are funds used by a company to acquire, upgrade, and maintain physical assets such as property, buildings, an industrial plant. Census Bureau, IRS Data and Administrative Expenses Multipliers. The monthly expense form is suitable for both individuals and businesses. This budgeting template helps you more quickly and easily stay on top of your finances. However, other information needed to complete the forms comes from the Census Bureau and the Internal Revenue Service (IRS). Easily track your money with this simple monthly budget template. Some of the information needed to complete these forms, such as a debtor's current monthly income, comes from the debtor's own personal records. Ī debtor must enter income and expense information onto the appropriate form ( i.e., the 122A Forms or the 122C Forms) and then make calculations using the information entered. Official Form 122C-1 (Statement of Your Current Monthly Income and Calculation of Commitment Period) and Official Form 122C-2 (Chapter 13 Calculation of Your Disposable Income) (collectively the “122C Forms”) are designed for use in chapter 13 cases. Official Form 122A-1 (Chapter 7 Statement of Your Current Monthly Income), Official Form 122A-1Supp (Statement of Exemption from Presumption of Abuse Under § 707(b)(2)), and Official Form 122A-2 (Chapter 7 Means Test Calculation) (collectively the “122A Forms”) are designed for use in chapter 7 cases. Most individual debtors filing for bankruptcy relief are required to complete a version of Bankruptcy Form 122.

#MONTHLY EXPENSES FORM FREE#

Need More Help With Budgeting and Bill Pay?īe sure to check out these other free printables.Census Bureau, IRS Data and Administrative Expenses Multipliers If you’re having trouble printing or editing one of our printables, click here for help.

#MONTHLY EXPENSES FORM PDF#

Many web browsers have their own built-in PDF viewers, but they tend to be buggy. If you save it, you’ll be able to tweak it throughout the month, if you need to. Once you’re happy with your budget, print it out, or save it to a device. Make those things a part of your budget, and you’re much more likely to follow through with them. Since we’re all about side hustles, saving and paying off debt around here, you’ll also see that this budget worksheet has room to enter multiple income streams, and to plan how much you’re going to save and pay off this month.

To budget for expenses that you only pay once a year, just divide those costs by 12 to arrive at their monthly cost to you. You want your budget to reflect your true out of pocket costs for the month. Also leave off health, life, dental, vision and disability insurance, if they’re automatically deducted from your pay. If there’s an expense listed that doesn’t pertain to you, just enter a zero in the field next to it.ĭon’t include homeowner’s insurance or property tax, if they’re included in your mortgage payment. Want to see how certain changes would impact your budget? Go back and tweak the numbers as many times as you’d like, and the total will continue to update. For example, let’s say your household income is 60,000 a year after taxes. Just input your monthly income and expenses, and the worksheet will automatically crunch the numbers as you go. Once you’ve categorized your expenses and come up with a percentage-based budget, you can finetune your spending. And it even has extra space for you to enter additional expenses. It includes lots of things that other budget worksheets leave off – stuff like streaming services, pet care and gifts. Use this printable monthly budget worksheet to create a budget that matches your lifestyle and your goals.

0 kommentar(er)

0 kommentar(er)